Media Library

Explore RIC documents, loan information, media releases, brand assets and images currently available to stakeholders. We encourage you to download and share this information with your networks

Text:

______________________________________________________________________

New RIC Drought Hardship Loan and Marine Algal Bloom and Heatwave Loan will be available in the first half of 2026.

☀️ Drought Hardship Loan:

Loan to help with short-term operating costs for long-term drought.

- For farm businesses in drought for at least 24 months and expect to be for another season

- Borrow up to $250,000

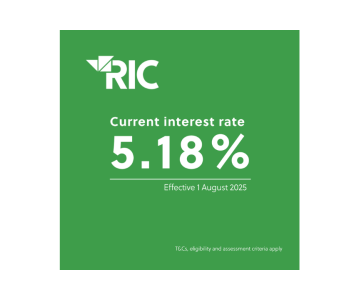

- Current variable interest rate 5.18%*

- 5-year loan term

- No payments in the first 2 years**

*Interest rate effective 1 February 2026. Interest rates reviewed every 6 months. **Interest will accrue in the first two years to be paid within the 5-year loan term.

🐟 Marine Algal Bloom and Heatwave Loan:

Loan to help with South Australian wild-catch fishers and aquaculture operators affected by the recent algal bloom.

Want to receive updates? Register at ric.gov.au/new-loans

______________________________________________________________________

Instagram tag: @ ric_gov_au

Facebook tag: @ ricgovau

Suggested newsletter copy:

Register for updates on new RIC loans coming in 2026

Two new RIC loans will be available for farmers and producers in the first half of 2026 to provide relief during financial hardship.

A new Drought Hardship Loan is coming to assist farmers in long-term drought with short-term financial relief. It will be for farmers in drought for at least 24 months and expect to be for another season. Eligible farmers will be able to:

- Borrow up to $250,000

- Current variable interest rate 5.18%

- 5-year loan term

- No payments in first 2 years**

- Eligibility, credit and risk assessment criteria apply

** Interest will accrue in the first two years to be paid within the 5-year loan term.

A Marine Algal Bloom and Heatwave Loan will be to assist South Australian wild-catch fishers and aquaculture operators affected by the recent algal bloom.

Want to register for updates on the new loans? Visit www.ric.gov.au/new-loans

An additional new loan for improving climate resilience, boosting sector productivity, and supporting agriculture to be part of Australia’s net zero transition is coming in the second half of 2026.

Text:

______________________________________________________________________

A RIC AgriStarter Loan has two key aims:

1. Help first generation farmers obtain their own farm business, and 2. Support next generation farm businesses with their succession plans, helping to keep Australian farms in the family. The loan can be used to refinance debt, purchase existing farm businesses, land, or infrastructure, or fund succession activities such as buying out relatives or pay succession planning costs.

To see if an AgriStarter Loan is right for you, take our eligibility quick quiz at ric.gov.au/quickquiz

______________________________________________________________________

Instagram tag: @ ric_gov_au

Facebook tag: @ ricgovau

Text:

______________________________________________________________________

A RIC Farm Investment Loan can help eligible farm businesses to recover and prepare after a severe business impact from drought, natural disasters, or biosecurity event.

The loan can be used to fund risk management activities, refinance debt to improve cash flow, enhance productivity, and paying for operating or capital expenses to build your farm business.

To see if a Farm Investment Loan is right for you, take our eligibility quick quiz at ric.gov.au/quickquiz

______________________________________________________________________

Instagram tag: @ ric_gov_au

Facebook tag: @ ricgovau

Text:

______________________________________________________________________

A RIC Drought Loan can help eligible farmers prepare, manage through and recover from drought.

If your farm business suffered a significant financial disruption as a result of drought over the past 5 years, you may be eligible for a Drought Loan.

To see if a Drought Loan is right for you, take our eligibility quick quiz at ric.gov.au/quickquiz

______________________________________________________________________

Instagram tag: @ ric_gov_au

Facebook tag: @ ricgovau

Text:

______________________________________________________________________

RIC variable interest rate for farm business loans is on hold at 5.18 per cent effective 1 February 2026.

Farmers in tough financial times due to situations outside their control from drought, flood or other natural disasters may be eligible to apply for a RIC Drought Loan, Farm Investment Loan and AgBiz Drought Loan.

RIC’s AgriStarter Loan is also available for new farm businesses or succession planning to keep family farms in the family.

Farmers can restructure up to 50 per cent of their existing debt to improve cash flow to gain some financial breathing space. For more on RIC loans visit ric.gov.au/loans

______________________________________________________________________

Instagram tag: @ ric_gov_au

Facebook tag: @ ricgovau

Loan products flyers

A brief side-by-side comparison of our loan product interest rates and terms.

A brief look at the benefits and features of the AgriStarter Loan.

A brief look at the benefits and features of the Farm Investment Loan.

A brief look at the benefits and features of the Drought Loan.

A brief look at the benefits and features of the AgBiz Drought Loan.

A brief side-by-side comparison of our loan product interest rates and terms.

A brief look at the benefits and features of the AgriStarter Loan.

A brief look at the benefits and features of the Farm Investment Loan.

A brief look at the benefits and features of the Drought Loan.

A brief look at the benefits and features of the AgBiz Drought Loan.

About RIC

Provides a clear overview of low-interest farm business loans, outlining loan features.

To support you with your application, we've put together 7 top tips to help you succeed.

Answers to a few of your questions regarding RIC Farm Loans

Find all our customer story videos and product information webinar replays on our YouTube channel.

Read out past customer stories of RIC loans recipients.

Provides a clear overview of low-interest farm business loans, outlining loan features.

To support you with your application, we've put together 7 top tips to help you succeed.

Answers to a few of your questions regarding RIC Farm Loans

Find all our customer story videos and product information webinar replays on our YouTube channel.

Read out past customer stories of RIC loans recipients.

Customer tools

Farm Relief Tool

A tool to connect farmers with Australian Government financial assistance and community support to help prepare for, and recover from drought, natural disaster or biosecurity events.

Learn more

Quick Quiz

Take our quick quiz tool to understand the eligibility criteria and key guidelines for each loan before considering whether to apply.

Webinar replays

Understand more about eligibility criteria before applying and what you need to know before you submit an application.

Understand more about eligibility criteria before applying and what you need to know before you submit an application.

Learn how a RIC Drought Loan can support eligible farm businesses during challenging times.

![RIC Brand Logo [Square]](/sites/default/files/styles/link_tile/public/images/RIC%20Square%20Logo.png.jpeg?itok=zQveHDoR)

Social media / Newsletter / eDM content