We explain what counts as commercial debt and the difference between refinancing versus new debt with RIC.

What you will learn:

- What counts as commercial debt, and what doesn’t

- How RIC loans work for refinancing commercial debt versus new debt

What counts as commercial debt, and what doesn’t

To be eligible for a RIC loan, you must have commercial debt (or be on your way to being approved for commercial debt in the case of the AgriStarter Loan only).

Commercial debt is a financial commitment to repay that has been established on commercial interest rates, terms and conditions.

For example, a bank or other financial institution has taken formal security, and you hold a signed loan agreement, including mortgage or caveat documents.

Private and family loans may qualify as commercial debt if they are issued with commercial interest rates, terms and conditions.

Commercial debt does not include any of the following types of debt:

- Home loans, personal loans (for holidays, vehicles, medical expenses, home renovations, investment purposes etc.)

- Private or family debt that has not been provided at arm’s length, at commercial rates, with terms and conditions

- Non balance sheet loans

- Equipment finance facilities

- Funding of normal or additional working capital

- Debt at concessional interest rates established under government schemes (Australian Government, state or territory)

How RIC loans work for refinancing commercial debt versus taking on new debt

RIC loans can be used for:

- refinancing (restructuring existing debt)

- accessing new debt for operating expenses and capital expenditure.

Either way, after you have a RIC loan, at least 50 per cent of your total debt must still be commercial debt. So, the total amount of your RIC loan cannot be more than the amount of your commercial debt.

The maximum borrowing amount for each RIC farm business loan including AgriStarter, Drought and Farm Investment is $2 million.

The maximum amount you can borrow for the AgBiz Drought Loan is $500,000. Borrowers can have more than one RIC loan however, the total amount borrowed for RIC loans cannot exceed $2 million.

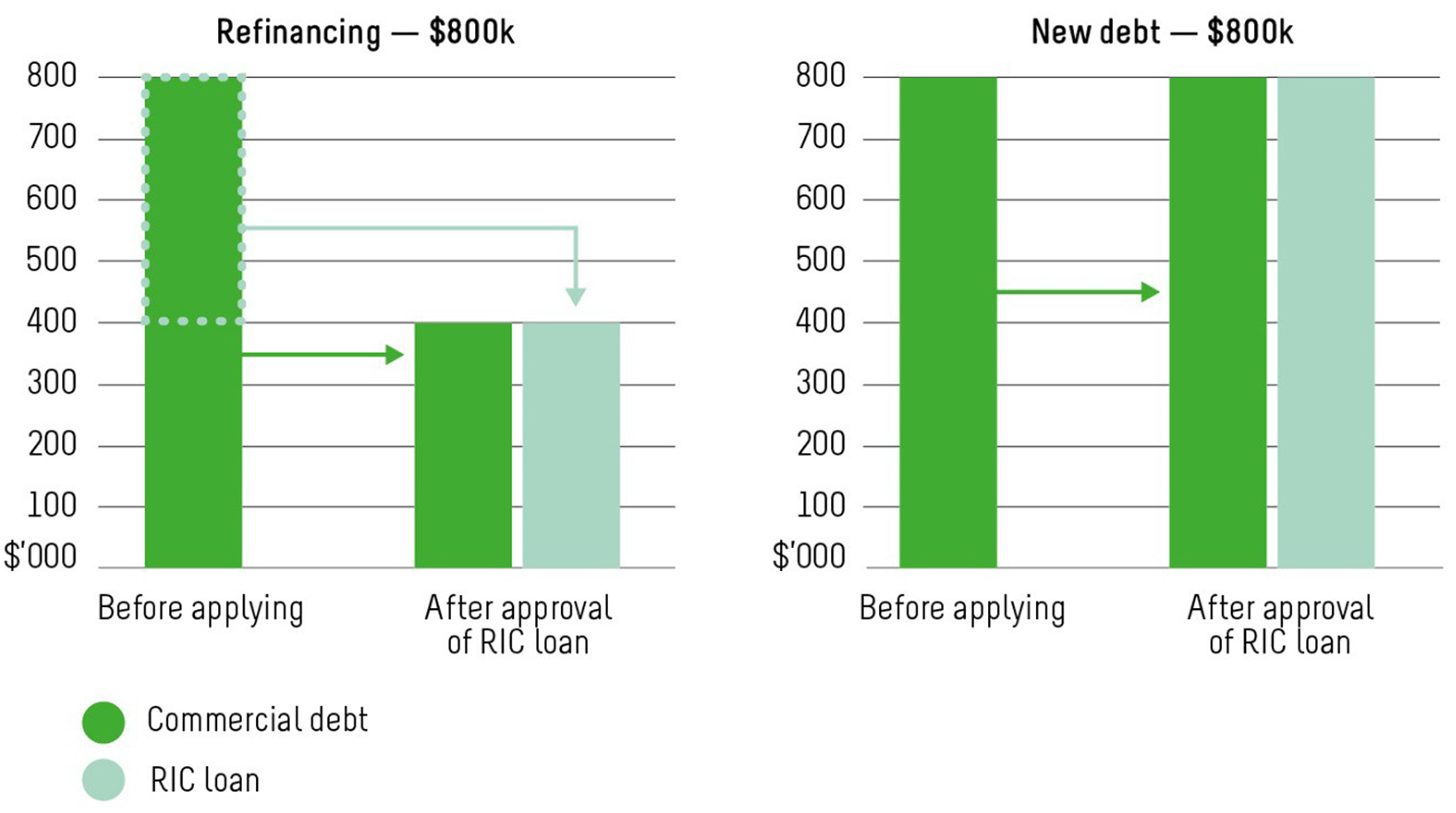

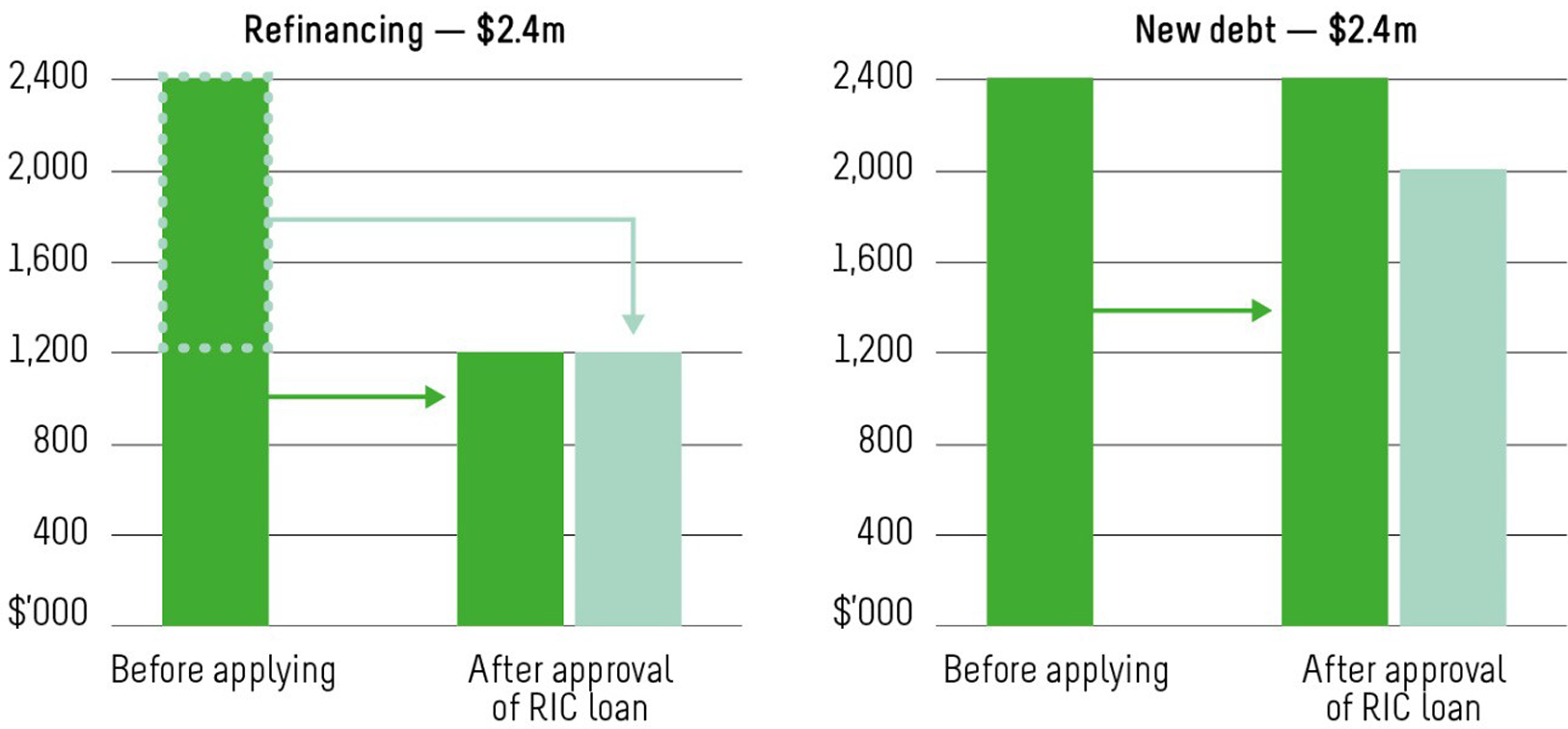

For example, see Figures 1 and 2 below.

Figure 1 shows two scenarios for a farm business applying for a RIC Drought Loan with $800,000 in existing commercial debt.

- If they use their RIC loan to refinance, the maximum amount of the RIC loan is $400,000.

- If they use their RIC loan to access new debt, the maximum amount of the RIC loan is $800,000.

Figure 2 shows two scenarios for a farm business applying for a RIC Drought Loan with $2.4 million in existing commercial debt.

- If they use their RIC loan to refinance, the maximum amount of the RIC loan is $1.2 million.

- If they use their RIC loan to access new debt, the maximum amount of the RIC loan is $2 million.

Note: Under a new debt of $2.4 million, the loan amount does not match the amount held in commercial debt because the maximum amount of a loan is capped at $2 million.

If you have questions about commercial debt, contact us.